Curious about becoming an Enrolled Agent (EA)? An enrolled agent course is your gateway to securing the highest IRS credential, empowering you to represent taxpayers in various tax matters. This article breaks down what you need to know about the EA credential, exam structure, and the best ways to prepare.

Key Takeaways

- Enrolled Agents (EAs) hold unlimited practice rights and are federally licensed to represent taxpayers before the IRS, making them highly valuable tax professionals.

- The EA Exam consists of three parts focusing on individual taxation, business taxation, and representation practices, requiring in-depth knowledge of tax laws.

- Becoming an EA opens various career opportunities across sectors, including public accounting, tax representation firms, and independent practices, with competitive salary ranges both in India and abroad.

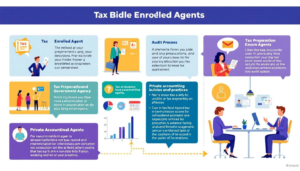

Understanding the Enrolled Agent (EA) Credential

An Enrolled Agent (EA) is an elite tax professional authorized to represent taxpayers before the IRS in all tax matters. What sets EAs apart is their unlimited practice rights, meaning they can represent any taxpayer, for any tax matter, in any IRS office.

The EA credential is the highest credential awarded by the IRS, and it allows practitioners to act on behalf of taxpayers in federal tax matters. This federal licensing designation is recognized and respected, making EAs highly sought after in the field of taxation.

Whether you’re preparing tax returns or representing clients during audits, the EA credential equips you with the authority and expertise needed to excel.

Unlimited Practice Rights

One of the most significant advantages of becoming an Enrolled Agent is the unlimited practice rights it confers. This means EAs can represent any taxpayer, handle any tax matter, and operate in any IRS offices without restrictions.

Unlike other tax professionals who may have limitations on the types of clients they can represent, EAs enjoy a broad scope of practice, making them invaluable in law firms, tax representation firms, and other organizations that require comprehensive tax expertise.

Federal Licensing for Tax Matters

The Enrolled Agent credential is a federal licensing designation recognized by the IRS, which allows EAs to represent taxpayers in various tax matters. To become an Enrolled Agent, candidates must pass a rigorous three-part IRS test or have experience as a former IRS employee.

This federal recognition ensures that EAs are well-versed in tax laws, compliance, and representation practices and procedures, making them highly effective in resolving outstanding tax liabilities and ensuring tax compliance.

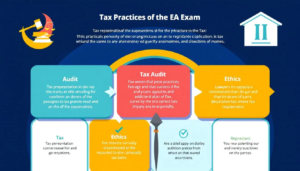

Overview of the EA Exam

The EA Exam, also known as the IRS Special Enrollment Examination (SEE), is a comprehensive assessment designed to evaluate candidates’ ability to represent clients in tax matters before the IRS. This exam is crucial for anyone looking to obtain the EA credential, as it tests knowledge of federal tax laws, ethics, and procedures.

The EA exam consists of multiple-choice questions that cover a wide range of topics related to federal taxation and ethical practices. To qualify as an Enrolled Agent, candidates can either pass this three-part examination or have relevant former IRS employment experience. The EA exam is designed to ensure that only well-prepared and knowledgeable individuals can achieve EA status, making it a challenging but rewarding endeavor.

Three-Part Exam Structure

The EA exam is divided into three parts:

- Individuals: Emphasizes tax law as it pertains to individuals and their unique situations.

- Businesses: Focuses on taxation related to business entities.

- Representation, Practices, and Procedures: Covers aspects of tax representation and procedural rules.

Each part focuses on different aspects of taxation, allowing candidates to develop a deep understanding of complex tax topics.

The Businesses section covers business taxation related to various business structures and practices, while the Procedures Representation, Practices, and Procedures part focuses on ethical practices and procedural rules governing tax representation. This structure ensures a comprehensive evaluation of a candidate’s knowledge and skills, preparing them for real-world tax matters.

Exam Fees and Scheduling

Candidates must pay a fee of $259 for each part of the EA exam, totaling $777 for all three parts. Additionally, a non-refundable fee of $203 applies for scheduling each part of the exam, which is paid at the time of appointment.

Candidates can schedule their EA exams through Prometric’s online platform, which provides access to various testing locations, including major cities in India like Hyderabad and Delhi, and allows candidates to check their exam date.

Essential Study Materials for EA Exam Preparation

It is important to invest time and effort in comprehensive EA study materials. Doing so will ensure that all parts of the EA exam are adequately covered. A well-rounded preparation includes guided and comprehensive resources such as:

- Study guides

- Digital EA exam books

- Flashcards

- Practice questions.

These materials are indispensable for effective preliminary work and maximizing chances of success.

Comprehensive Study Guides

Quality EA courses provide over 250 hours of preparatory content, ensuring comprehensive exam readiness. Detailed study guides not only prepare candidates for exam success but also bridge the gap between theory and practice in tax law.

These guides should include up-to-date materials that reflect current tax laws and internal revenue service irs regulations, incorporating actual case studies to help students relate theoretical knowledge to practical situations in taxation.

Digital and Interactive Resources

Digital and interactive study materials are essential tools for candidates preparing for the EA exam. These resources, such as webinars and videos, create an engaging learning experience that enhances understanding and retention of complex topics.

Incorporating these tools into your study plan can significantly improve your preparation and confidence.

Practice Questions and Mock Tests

Mock tests simulate the actual exam environment, helping candidates acclimatize to the testing conditions. A robust EA course should include detailed notes, multiple mock tests, and about 1,000 to 1,500 practice questions to ensure thorough preparation.

These practice questions and mock exams are essential for mastering exam concepts and familiarizing oneself with the exam format.

Choosing the Right EA Course

TSelecting the right EA course is crucial for effective examination preparation. Candidates should prioritize courses that provide comprehensive coverage of the EA exam syllabus, ensuring that all essential topics are covered.

A thorough curriculum enhances the likelihood of mastering the exam topics and achieve a clear understanding to achieve passing scores.

Course Content and Quality

A thorough study guide should include an overview of exam content, structure, and candidate preparation strategies. Quality course content is crucial for thorough preparation for the EA exam, ensuring that all essential topics are covered.

Well-structured study guides enhance a candidate’s ability to understand and retain information, increasing their chances of exam success.

Expert Instructors

Expert instructors offer guidance and mentorship, helping students navigate complex tax topics effectively. Learning from experienced instructors who are industry veterans or former IRS employees is crucial for success in the EA exam.

Their past technical experience and professional certification ensure that candidates receive the best possible expert training.

Placement Assistance

Placement assistance is a critical support service that helps Enrolled Agent course students find job opportunities after certification. The course offers a 3-day offline placement grooming programme to prepare students for job placements.

Twenty-One Training and Study Solutions (TWSS) provides placement assistance for eligible candidates to maximize their job search success. The placement program has successfully facilitated over 4,500 placements, showcasing its effectiveness in connecting students with job opportunities.

Scope of EA for Indian Students

Indian students can significantly enhance their career prospects in taxation by pursuing the enrolled agent certification, which is recognized globally. Becoming an enrolled agent allows Indian professionals to represent taxpayers before the internal revenue service, opening up significant job opportunities both domestically and internationally.

The EA certification equips Indian students with comprehensive knowledge of U.S. tax laws, making them valuable assets in multinational firms. With this certification, Indian students can differentiate themselves in the competitive finance job market, especially in roles related to tax consultancy. The global recognition of the EA credential ensures that Indian EAs are in high demand across various sectors, including corporate finance, small business consulting, and tax advisory services.

Furthermore, Indian students with EA certification can pursue careers in diverse environments such as government agencies, private corporations, and non-profit organizations. This flexibility and wide range of career paths make the EA certification an attractive option for those looking to build a successful and rewarding career in taxation.

Step-by-Step Process to Become an EA from India

Individuals must follow these steps to become an Enrolled Agent (EA):

- Obtain a Preparer Tax Identification Number (PTIN) to initiate the process.

- Apply to take the Special Enrollment Examination.

- The examination consists of three parts covering different aspects of taxation.

- Achieve a passing score on all three parts of the Special Enrollment Examination to qualify for enrollment as an EA.

After passing the exam requirement, candidates must submit an application for enrollment and pay a fee of $140. A suitability check is conducted as part of the enrollment process to ensure tax compliance and review any criminal background.

Enrolled Agents must complete 72 hours of continuing education every three years to maintain their credential. The Special Enrollment Examination is not offered during the months of March and April due to updates in tax law.

Practical Learning Techniques

Instructors with extensive practical experience enhance the learning process by providing real-world insights. Practical learning techniques are crucial for enhancing knowledge retention and application in real-world scenarios.

Incorporating practical and real-life examples ensures that students can relate theoretical knowledge to practical situations, making abstract concepts more tangible and relatable.

Real-Life Examples

Real-life examples serve as a practical tool for understanding complex tax laws, making abstract concepts more tangible and relatable. Incorporating real-life scenarios into learning helps students grasp intricate tax situations they may encounter in their careers.

Skill-based training provided by experienced professionals includes examples from real cases, reinforcing students’ understanding and preparation for the exam.

Skill-Based Training

Skill-based training prepares students by teaching core practical skills necessary for job readiness. The training is conducted by ex-industry veterans with decades of experience, ensuring relevance to current job requirements.

Skill assessments during training sessions help identify individual strengths and areas for improvement.

Online Learning Platforms and Tools

Candidates should assess course recognition and reviews from former students when selecting an EA program. Online learning platforms and tools, such as Learning Management Systems (LMS) and mobile apps, offer flexible and on-demand learning experiences.

These platforms provide hands-on workshops and skill-based training, often including hands-on projects that mirror real-world tax situations.

Learning Management Systems (LMS)

Miles offers a robust LMS platform along with McGraw-Hill textbooks as part of their exam preparation resources. The LMS can be accessed from any computer and mobile apps for Android and iOS, ensuring convenient learning anywhere.

Learning Management Systems (LMS) are essential for providing flexible and on-demand learning experiences, making it easier for candidates to study at their own pace and schedule.

Mobile App Access

Mobile applications fundamentally change the way candidates prepare for the EA exam, providing the tools necessary to study effectively. Mobile apps designed for EA exam preparation enable users to study anytime, anywhere, enhancing flexibility in learning.

With mobile apps, candidates can access study materials, practice tests, and other resources on-the-go, ensuring they can make the most of their preparation time during the test window.

Maintaining Your EA Certification

Maintaining your EA certification requires completing 72 hours of continuing education every three years, including at least 6 hours focused on ethics. This requirement ensures that Enrolled Agents stay updated on the latest tax laws and best practices, maintaining their professional certification and EA credential.

Continuing Education Requirements

Enrolled agents must complete continuing education to maintain their certification and stay updated on tax laws. The requirements are:

- At least 16 hours of continuing education must be completed each year.

- A total of 72 hours is required over a three-year period.

- Out of the 72 hours needed every three years, at least 6 hours must focus on ethics.

The renewal of your EA status occurs every three years and should be completed by the end of the cycle.

Renewal Process

The renewal process requires submitting Form 8554 and can be completed online or via paper, depending on preference. This process involves submitting Form 8554 either online or by mail, along with the necessary fees.

The renewal process is crucial for maintaining active Enrolled Agent status and ensuring continued practice rights.

Career Opportunities for Enrolled Agents

Enrolled Agents can pursue careers in various sectors, including public accounting, small businesses, and government agencies. They can work in diverse fields such as corporate finance, small business consulting, and tax advisory services, enhancing their career prospects. The flexibility and wide range of career paths available make the EA credential highly valuable.

EAs can work in diverse environments such as government agencies, private corporations, and non-profit organizations. With the EA credential, professionals can find job opportunities in corporate accounting departments, tax representation firms, and even start their own independent practice. This broad scope ensures that EAs have numerous placement opportunities and can build a successful career in taxation.

Corporate Accounting Departments

In corporate accounting, EAs are valuable for their ability to ensure compliance with tax regulations and assist with financial reporting. They typically handle compliance, reporting, and tax planning, making them essential in ensuring financial accuracy and legal adherence.

EAs in corporate settings often help manage tax compliance and financial reporting, providing vital support to businesses.

Tax Representation Firms

Tax representation firms require EAs to manage client representation in IRS matters, providing essential support during audits. These firms commonly hire EAs to assist clients with audits and disputes, leveraging their specialized tax knowledge.

Tax representation firms value EAs for their expertise in navigating complex tax regulations and representing clients in audits and disputes. Tax pros play a crucial role in this process.

Independent Practice

Starting an independent practice as a tax professional allows EAs:

- Flexibility in managing their client base

- Setting their working hours

- Setting their own fees

- Choosing their clients

This independence offers greater flexibility in their work.

Establishing an independent practice allows EAs to tailor their services and client base according to their interests and expertise.

Salary & Career Opportunities in India & Abroad

In India, Enrolled Agents (EAs) can expect the following salary ranges based on experience:

- Newly qualified EAs starting out in U.S. tax preparation firms: ₹3,50,000 to ₹6,00,000 per year

- EAs with 3 to 5 years of experience: ₹8,00,000 to ₹12,00,000 annually

- Senior EAs, particularly those leading teams: ₹15,00,000 to ₹25,00,000 per year

In the U.S., Enrolled Agents (EAs) typically earn the following annual salaries:

- Entry-level EAs: $50,000 to $60,000

- Mid-level EAs: $70,000 to $90,000, depending on their specialization

- Senior Enrolled Agents: $100,000 to $150,000, especially if they manage their own firm

In regions like the Middle East and Europe, salaries for EAs vary from $40,000 to $90,000 per year, influenced by local demand for tax services.

Summary

In summary, becoming an Enrolled Agent offers significant career opportunities and the ability to represent taxpayers before the IRS. By understanding the EA credential, preparing effectively for the EA exam, and choosing the right course, you can set yourself up for success. The journey to becoming an EA is challenging, but with dedication and the right resources, you can achieve this prestigious credential and enjoy a rewarding career in taxation.

Embrace the challenge, invest in your education, and watch your career soar as an Enrolled Agent.

Frequently Asked Questions

What is an Enrolled Agent (EA)?

An Enrolled Agent (EA) is a tax professional who can represent you before the IRS in all tax matters, making them one of the top experts you can turn to for handling complex tax issues. They hold the highest credential awarded by the IRS, ensuring you get knowledgeable assistance.

What are the benefits of unlimited practice rights for EAs?

Unlimited practice rights give EAs the freedom to represent any taxpayer and handle all tax matters without restrictions, making them a key asset in organizations needing extensive tax knowledge. This flexibility enhances their value and effectiveness in the field.

How is the EA exam structured?

The EA exam has three parts: Individuals, Businesses, and Representation, Practices, and Procedures, each covering key taxation topics to thoroughly assess your expertise. So, it’s important to prepare for each section to succeed!

What are the continuing education requirements for maintaining EA certification?

To keep your EA certification active, you need to complete 72 hours of continuing education every three years, with at least 6 hours dedicated to ethics. Staying updated on tax laws is crucial for your practice!

What are the career prospects for Enrolled Agents in India and abroad?

Enrolled Agents have strong career prospects both in India and abroad, with salaries ranging from ₹3,50,000 to ₹6,00,000 in India and $50,000 to $60,000 in the U.S. as entry-level professionals, increasing with experience. It’s a promising field with diverse opportunities in accounting and tax representation.