- Under the existing tax provisions, you can file your tax return without any penalty till the end of the assessment year.

- If you delay tax filing beyond assessment year, tax officer can impose the penalty up to Rs. 5,000, which is done very rarely and fails to create any impact on taxpayers.

- To tighten the noose around stubborn non-filers, in budget 2017 the government has introduced a new section 234F which levies mandatory late filing fees for non-filing the tax returns within allowed time.

- As per the new provisions, if a taxpayer misses the due date of 31stJuly but files his return by 31st of December, the quantum of fee payable will be Rs. 5,000.

- Further, if he delays the filing beyond 31st December, the fees will be increased to Rs. 10,000. But keeping the interest of small taxpayers (with income up to Rs. 5 lakh), in mind, the government has kept the fees much lower for them.

- The late filing fees for such taxpayers will be maximum Rs. 1,000. If such taxpayer is filing his return for the first time, then I-T department will not scrutinise his ITR unless it has specific information regarding suspicious high-value transactions. The mandatory late filing fee will be applicable from A.Y. 2018-19 onwards but old penalty provision will be applicable on older assessment years.

- Hopefully, this new ITR will make tax filing simpler for you. We will provide you all the necessary information regarding the form once it comes out.

- However, if you still find tax filing complicated, boring and time-consuming, you can use our Income Tax Filing services to get your taxes done easily. You can file your taxes online with us within 10 minutes using our self e-filing service or just upload your Form 16 to get your taxes filed by our team of in-house tax experts.

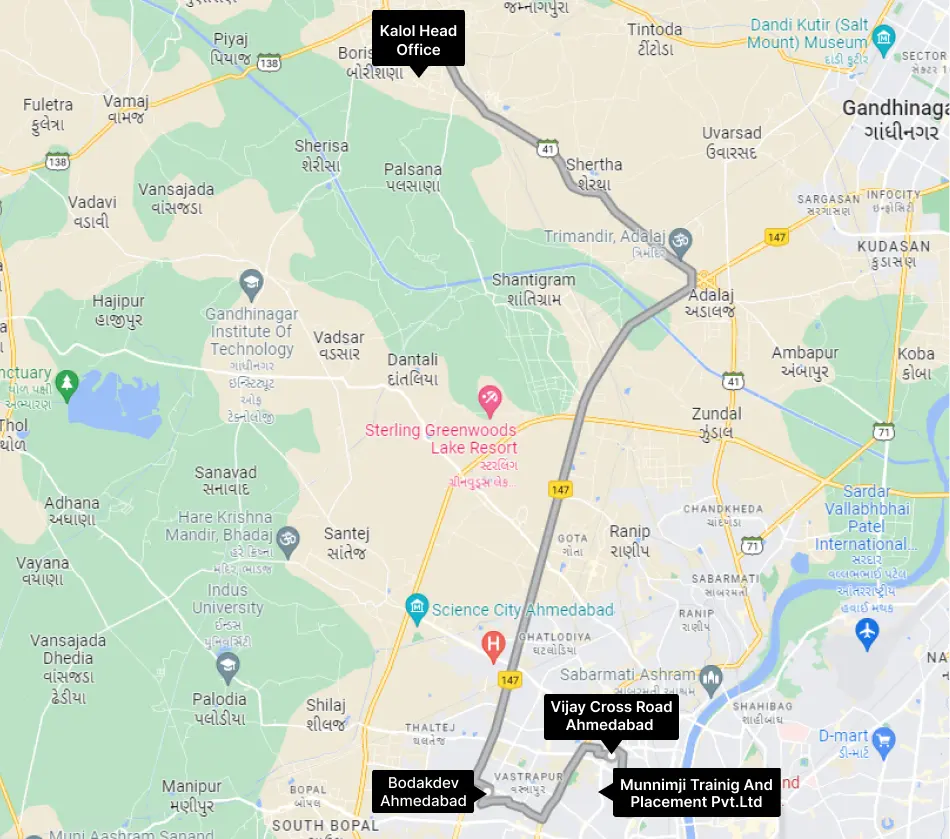

- Alternatively, you can choose to visit any of our retail offices to get face-to-face tax assistance.